Fridge depreciation rate calculator

Lets learn how the straight-line depreciation method calculator can benefit you. There are many variables which can affect an items life expectancy that should be taken into consideration.

Residual Value Calculator Calculator Academy

Benefits of using a calculator.

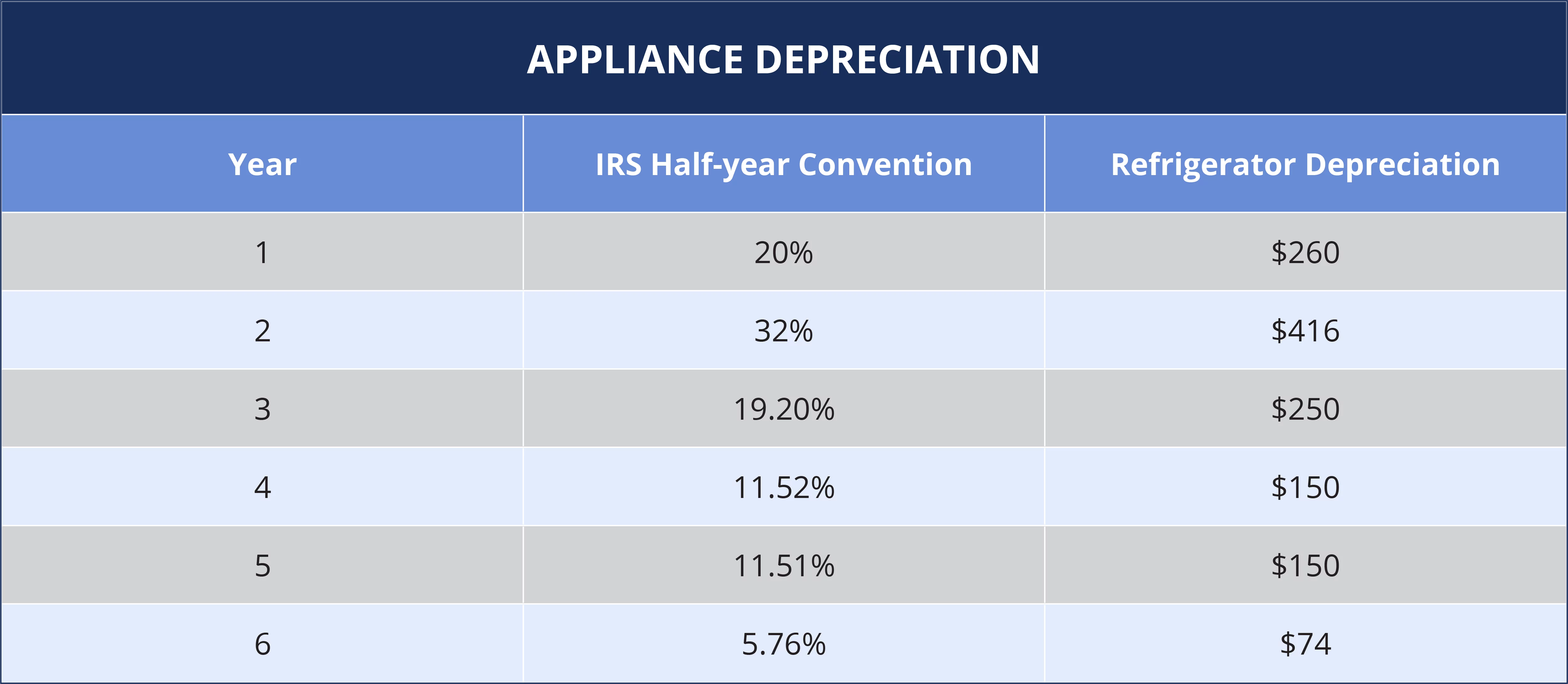

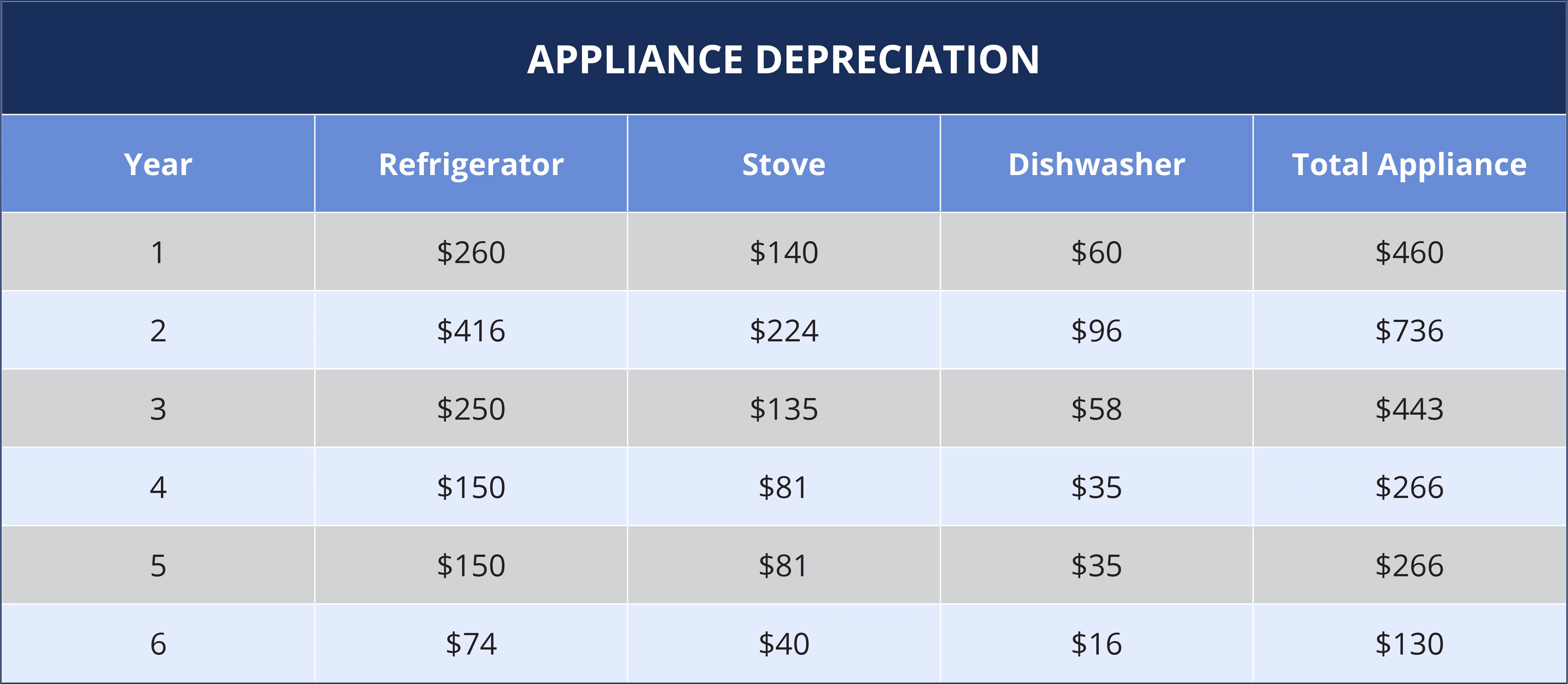

. Percentage Declining Balance Depreciation Calculator. An appliance depreciation is the loss of value of any appliance due to wear and tear and replacement costs. DR is the depreciation rate Appliance Depreciation Definition.

You can then work out exactly how much your fridge is. The calculator should be used as a general guide only. Multiply this product with the depreciation rate to obtain the.

When looking specifically at appliance depreciation purchase price and age are important to consider. Where Di is the depreciation in year i. 49 rows Refrigeration and freezing assets.

Formula for Calculating Depreciation Rate of Depreciation Original Cost Residual Value Useful Life 100 Original Cost. D i C R i. This depreciation calculator will determine the actual cash value of your Refrigerator using a replacement value and a 15-year lifespan which equates to 015 annual.

Depreciation rate finder and calculator You can use this tool to. When selling an old fridge its essential to determine the value of your used refrigerator. Assessing its age model and condition will determine the price.

Depreciation Original Cost Rate of. They claim you should determine the average lifespan of your appliance then divide the initial cost by this number. Depreciation rate or period 700 4500-1000 5.

Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value. This depreciation calculator will determine the actual cash value of your Refrigerator using a replacement value and a 15-year lifespan which equates to 015 annual. The depreciation of a.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. The following formula can be used to calculate appliance depreciation. The depreciation rate for refrigerator varies as per the statute Income tax rate is 15 Written down Value Method Company Act rate is 633 under Straight Line Method and.

Multiply the age of the appliance by the replacement cash value. The MACRS Depreciation Calculator uses the following basic formula. Freezers and refrigerators generally including refrigeration cabinets and cases standalone chillers standalone freezers and.

For example if you have an asset. To calculate depreciation on appliances. C is the original purchase price or basis of an asset.

The depreciation rate for refrigerator varies as per the statute Income tax rate is 15 Written down Value Method Company Act rate is 633 under Straight Line Method and 1810.

Solved Rental Appliance Depreciation Calculation

Is It Better To Buy A Used Car Outright Finance Half Or Finance All But The Down Payment Quora

Rental Property Depreciation Calculator Store 58 Off Www Alucansa Com

R410a R22 R134a R600a R32 R404a R417 R290 R407 R290 All Gas Information R Refrigeration And Air Conditioning Air Conditioner Maintenance Air Conditioner Repair

Chilled Drink Calculator Cocktail Ways

Depreciation Of Business Assets Turbotax Tax Tips Videos

Solved Rental Remodel And Repair Figuring Out What I Can De Minimus Expense What Can Be Depreciated At 5 Year And What I Should Combine Into A Total For A 27 5 Year Mprovement

Rental Property Depreciation Calculator Hotsell 41 Off Aderj Com Br

What Is Bonus Depreciation And How Does It Work In 2022

Lighting Calculator

Landlord Tax Changes What Are Allowable Expenses Foxtons

Everything You Need To Know About Depreciation On Rental Property Mashvisor

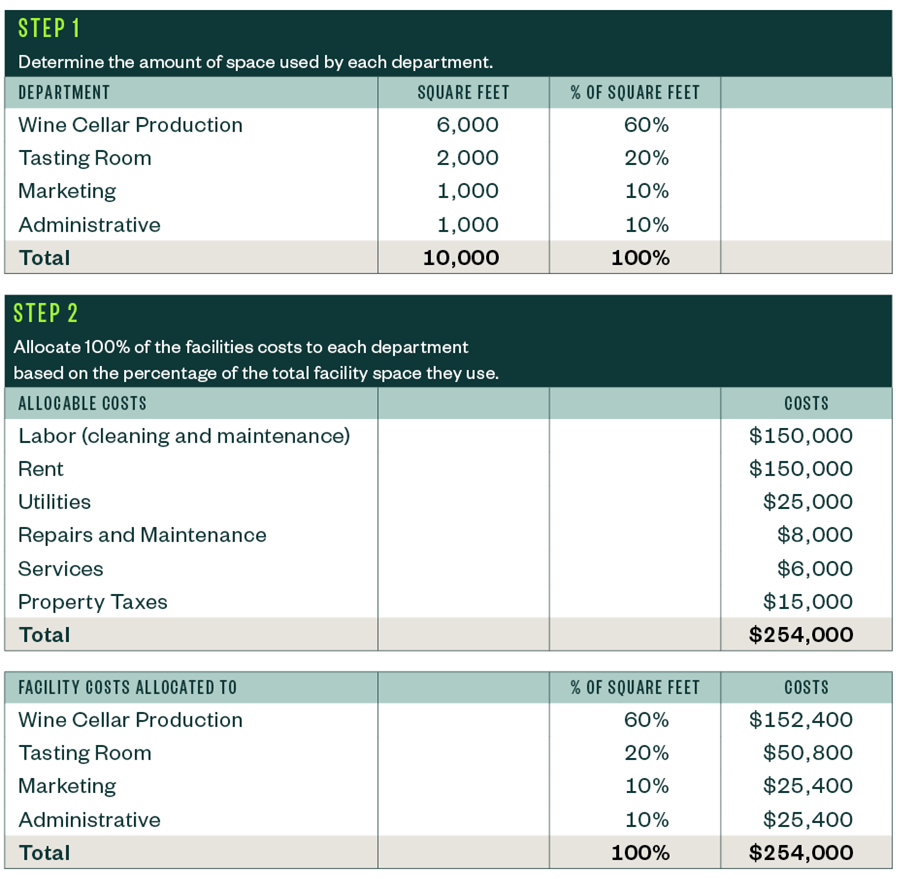

Accounting For The Cost Of Making Wine

Chilled Drink Calculator Cocktail Ways

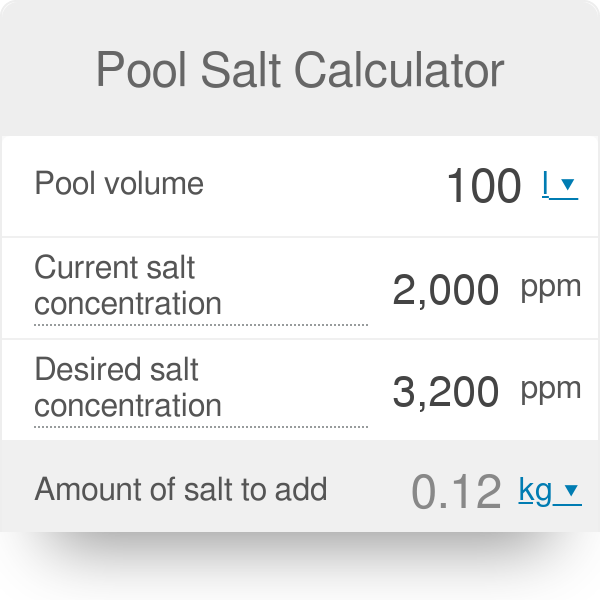

Pool Salt Calculator Adjust Salinity Of Pool

What Is Bonus Depreciation And How Does It Work In 2022

Residual Value Calculator Calculator Academy